The commencement of the European economic crisis took place when a great deal of mortgages in the United States were packaged and sold to the banks of Europe by the different financial entities and institutions within the United States.

The commencement of the European economic crisis took place when a great deal of mortgages in the United States were packaged and sold to the banks of Europe by the different financial entities and institutions within the United States.

This has caused interweaving effects in the different aspects of the current financial markets in different countries of the European continent.

Ireland’s economy

The very first sign of such problems in Europe were first seen in Ireland particularly on its euro zone and peripheral economy. The country actually had implemented draconian measures of austerity in order to prevent itself from in default and gets extremely affected due to its sovereign debts. But, there is one thing that is for sure; these measures were not good enough to save the country from being saved from the harsh effects of defaults.

To help the Ireland economy to surface from the mud of economic crisis, they managed to ask for help from IMF and EU. This has caused them to get a loan worth of eighty billion sometime in 2010. This is for the purpose of giving Ireland the opportunity to continue and implement its austerity plans, which are destined for the next 4 years.

In Greece

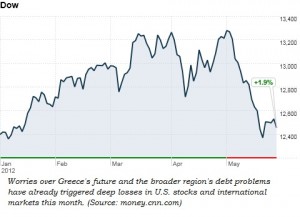

A lot of people during those times hoped that those problems will just start and end in Ireland but the problem seemed to infect other neighboring countries as well. Greece is in fact one of the European countries which has been affected and touched by the tentacles of the current economic difficulties. As a matter of fact, the problem, which was encountered by Greece, is more extreme compared to the economic difficulty suffered by Ireland.

Greece has an outstanding sovereign debt, which exceeds to forty billion Euros. This debt is quite big compared to the country’s GDP. Thus, this makes everyone think that the debt is much bigger than Greece’s GDP and this is really crippling the economic standing of the country so far. However, ECB/IMF is doing essential steps to bail out Greece’s current economy.

The Crisis Impact

- The fall of Greece’s economy has affected many financial entities in different parts of the world. This is especially true in terms of buying currencies in the foreign exchange market. Greek money becomes weak compared to other currencies, thus affecting much of the country’s economy.

- The effects of Greece’s financial hardship can be felt in most homes today and these can be seen in the rising of the prices of prime commodities and inflation of utility bills and many more. Where there is economic difficulty, rest assured that you can feel the effects wherever you are.

Recommended Articles: